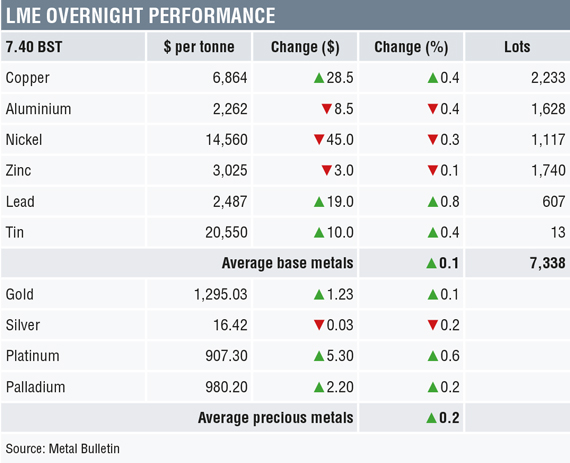

Three-month base metals prices on the London Metal Exchange were once again mixed on the morning of Thursday May 24, with copper up 0.4% at $6,864 per tonne, while aluminium, nickel and zinc prices were off between 0.2% and 0.5%.

Volume on the LME has been above average, with 7,338 lots traded as of 7.40 am London time.

This follows a general day of weakness on Wednesday that saw the complex down an average of 0.6%, led by a 1.8% fall in copper prices and nickel prices off 1.4%, although aluminium bucked the trend with a 0.4% rise.

Gold and silver prices are little changed with gold prices up by 0.1% at $1,295.03 per tonne and silver prices off 0.2%. Meanwhile, platinum is up 0.6% and palladium is up 0.2%.

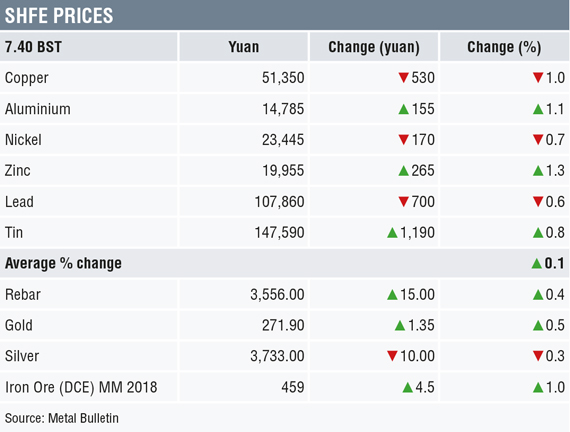

The metals in China were also mixed on the Shanghai Futures Exchange, with copper prices off by 1% at 51,350 yuan ($8,034) per tonne, zinc prices down by 0.7% and nickel prices off by 0.6%, while lead, aluminium and tin prices were up by 1.3%, 1.1% and 0.8% respectively.

Spot copper prices in Changjiang were down by 0.9% at 51,100-51,200 yuan per tonne and the LME/Shanghai copper arbitrage ratio has firmed to 7.49, from 7.47 on Wednesday.

In other metals in China, the ferrous metals have halted their slide with iron ore prices up by 1.0% at 459 yuan per tonne on the Dalian Commodity Exchange. On the SHFE, steel rebar prices were up by 0.4%, while gold prices were up by 0.5% and silver prices were down by 0.3%.

In wider markets, spot Brent crude oil prices were down by 0.11% at $79.54 per barrel this morning. The yield on US 10-year treasuries has eased further to 3.0041% and the German 10-year bund yield has eased to 0.5080%.

Equity markets in Asia were for the most part weaker on Thursday. The Nikkei fell -1.11%, the Hang Seng was flat, the CSI 300 was down -0.69% and the Kospi closed -0.24% lower, while the ASX 200 was up 0.08%. This follows a mixed performance in western markets on Wednesday, where in the United States the Dow Jones closed up by 0.21% at 24,886.81, and in Europe the Euro Stoxx 50 closed down by 1.27% at 3,541.82.

The dollar index, at 93.84, is consolidating Wednesday’s fresh gains when it set a high at 94.19. On the charts, there is likely to be resistance between 94.22 and 95.15.

The euro (1.1722) and sterling (1.3359) are off Wednesday’s lows and are consolidating but they still look vulnerable. The Australian dollar is also consolidating at 0.7554, while the yen at 109.57 is rebounding after its recent run to 111.39.

The yuan has extended its weakness at 6.3869 and the Asian emerging market currencies we follow remain weak, although the peso, Real and rand have got some lift off recent lows.

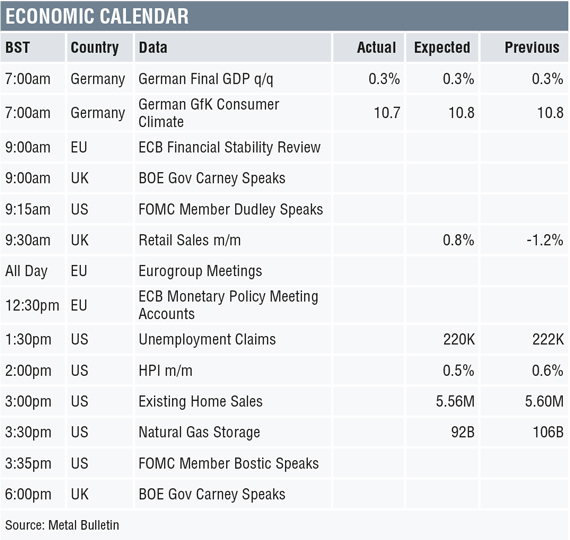

Today’s economic agenda is busy: Germany’s final GDP reading for the first quarter remained unchanged at 0.35, while its GfK consumer climate index dipped to 10.7 from 10.8 previously. Data out later includes an ECB financial stability review, UK retail sales, ECB monetary policy meeting accounts, with US data including initial jobless claims, house price index, existing home sales and natural gas storage. In addition, Bank of England governor Mark Carney is speaking at two events and Federal Open Market Committee members William Dudley and Raphael Bostic are also speaking.

Lead prices are rallying strongly, with prices up 11.6% since May 3. Copper, aluminium and nickel prices are meandering sideways, while zinc and tin prices have been under pressure. Without stronger economic growth, which seems unlikely with the continuing uncertainty over the world’s trade relations with the United States, sideways trading is likely to continue. We continue to expect dips to remain supported as economic growth is still present in most regions, even if it is slowing.

Gold prices have found support above $1,280 per oz and are getting some lift even though the dollar remains upbeat. That said, US treasury yields are drifting lower, which is likely to have taken some downside pressure of the metal. The other precious metals are consolidating after recent rebounds, but are likely to follow gold’s lead.